VAT refunds increased by almost 24% - tax authorities.

In the last five months of 2025, taxpayers have been refunded a substantial amount of VAT totaling 70.9 billion hryvnias. This is 23.8% more than in the same period last year. Additionally, this amount exceeds the figures for 2023 by 15%.

In May 2025, taxpayers received refunds amounting to 15.5 billion hryvnias, which is 22.3% more compared to May 2024. Compared to 2023, this amount increased by 55.9%.

In the first five months of 2025, taxpayers have received a record amount of VAT refunds, indicating an increase in the volumes of VAT refunds in Ukraine. This may be linked to business development and increased trade and service volumes. The positive trend in VAT refunds may contribute to the growth of the country's economy and improve the financial condition of enterprises.

Konstantin Shulgin, head of the State Tax Service of Ukraine, emphasized: 'The results of the refunds show a positive trend in the development of the country's economy and support for enterprises from the state.'During the first half of 2025, a record amount of VAT refunds was allocated to taxpayers in Ukraine, indicating favorable trends in the country's economic development and support for businesses from the state. This may have a positive impact on the economy and financial metrics of Ukrainian companies in the future.

Read also

- The number of blocked tax invoices has decreased by half - State Tax Service

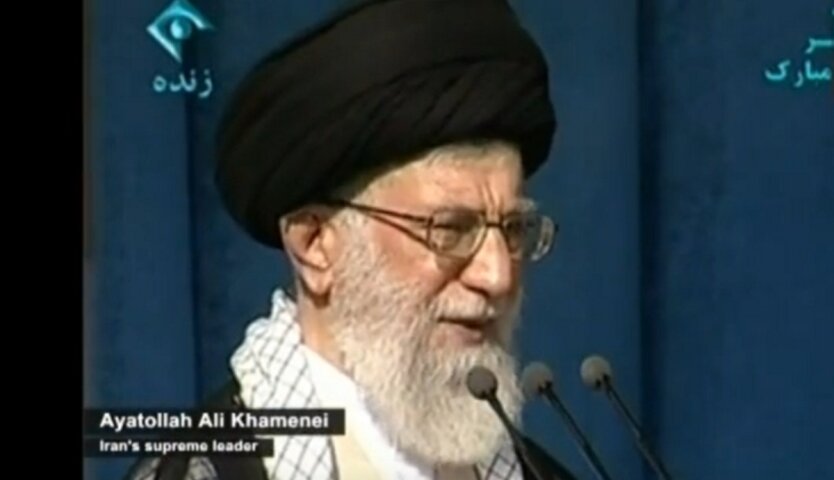

- Reuters: Gulf countries prepare for chaos in the event of the Iranian regime's collapse

- Britain highlights threats to Putin due to escalation between Israel and Iran

- Another group of seriously ill Ukrainian defenders has been released from Russian captivity

- Ukrainian wheat prices are falling ahead of the harvest season

- EU seeks ways to save Ukraine amid Trump threats: a discussion about Russian money